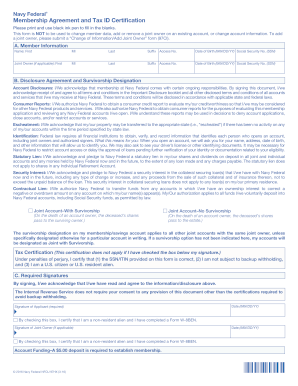

Navy Federal Tax Id Number

The Navy Federal Tax ID Number, also known as the Employer Identification Number (EIN), is a unique identifier assigned to businesses by the Internal Revenue Service (IRS) in the United States. It is a crucial piece of information for entities operating within the financial sector, particularly those affiliated with the military community. This article delves into the specifics of the Navy Federal Tax ID Number, its purpose, and its significance in the context of financial operations.

Understanding the Navy Federal Tax ID Number

The Navy Federal Tax ID Number is a nine-digit identifier assigned to Navy Federal Credit Union, a prominent financial institution serving the military community and their families. This number is a critical component in the identification and taxation processes of the organization, ensuring smooth financial operations and compliance with tax regulations.

Navy Federal Credit Union, established in 1933, is one of the largest credit unions in the United States, with a focus on providing financial services to members of the armed forces, Department of Defense employees, and their families. With its extensive network of branches and digital platforms, the credit union facilitates various financial transactions and services, making the accurate identification and tracking of these operations essential.

The Tax ID Number, or EIN, is used by the IRS to identify businesses for tax purposes. It is required for entities such as corporations, partnerships, trusts, estates, and certain government agencies, including credit unions like Navy Federal. The number is used on tax returns, other tax documents, and various forms of business correspondence to ensure accurate record-keeping and taxation.

The Purpose and Significance of the Tax ID Number

The Navy Federal Tax ID Number serves multiple critical functions within the organization’s financial framework:

- Taxation and Compliance: The Tax ID Number is a key identifier for tax purposes. It is used to report business income, file tax returns, and ensure compliance with federal and state tax regulations. Navy Federal Credit Union, as a large financial institution, handles significant financial transactions, making accurate taxation and compliance vital to its operations.

- Legal and Regulatory Requirements: The Tax ID Number is mandated by law for businesses of a certain size and structure. It ensures that Navy Federal Credit Union adheres to legal and regulatory frameworks, such as the Bank Secrecy Act (BSA) and the USA PATRIOT Act, which require financial institutions to maintain effective anti-money laundering programs and conduct thorough customer due diligence.

- Business Identification: The Tax ID Number serves as a unique identifier for Navy Federal Credit Union in various business transactions and communications. It is used on official documents, contracts, and correspondence, ensuring clarity and accuracy in business dealings. The number facilitates the smooth flow of information and transactions, both within the organization and with external partners and clients.

- Financial Reporting and Analysis: The Tax ID Number is integral to the financial reporting and analysis processes within Navy Federal Credit Union. It allows for the aggregation and analysis of financial data, enabling the credit union to make informed decisions, assess performance, and identify areas for improvement. Accurate financial reporting is crucial for maintaining the credit union's financial health and stability.

Navigating the Navy Federal Tax ID Number

Obtaining and using the Navy Federal Tax ID Number is a straightforward process. For Navy Federal Credit Union, the number is publicly available and can be easily accessed through various official channels, including the credit union’s website and public financial reports. This transparency ensures that stakeholders, including members, investors, and regulatory bodies, can readily access the information.

The number is typically displayed on official documents, such as tax returns, financial statements, and annual reports, providing a clear indication of the credit union's identity and facilitating the tracking of its financial activities. This accessibility enhances transparency and accountability, reinforcing the credit union's commitment to ethical and responsible financial practices.

In addition to its use in official documents, the Tax ID Number is often referenced in internal processes and systems within Navy Federal Credit Union. It is integrated into various software platforms and databases, enabling efficient data management, analysis, and reporting. The number's consistent use across these systems ensures data integrity and facilitates seamless information sharing and collaboration within the organization.

| Financial Year | Revenue (in millions) | Total Assets (in millions) |

|---|---|---|

| 2022 | $4.2 billion | $139.6 billion |

| 2021 | $3.9 billion | $132.8 billion |

| 2020 | $3.6 billion | $123.4 billion |

The table above illustrates the financial performance of Navy Federal Credit Union over the past three years, highlighting the organization's steady growth and financial stability. The consistent increase in revenue and total assets underscores the credit union's strong financial position and its ability to effectively serve its members and communities.

Frequently Asked Questions (FAQ)

What is the purpose of the Navy Federal Tax ID Number?

+The Navy Federal Tax ID Number, also known as the Employer Identification Number (EIN), is used for tax purposes. It identifies Navy Federal Credit Union in tax filings, ensuring accurate taxation and compliance with federal and state regulations. The number is essential for reporting business income and maintaining legal and regulatory compliance.

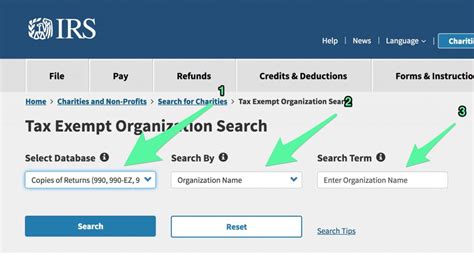

How can I find the Navy Federal Tax ID Number?

+The Navy Federal Tax ID Number is publicly available and can be easily accessed through official channels. You can find it on the credit union’s website, annual reports, and financial statements. Additionally, regulatory filings and public records may also contain the Tax ID Number.

Is the Tax ID Number the same as a Social Security Number for individuals?

+No, the Tax ID Number (EIN) is different from a Social Security Number (SSN). While the SSN is used to identify individuals for tax purposes and social security benefits, the Tax ID Number is assigned to businesses and organizations, including credit unions like Navy Federal. It serves a similar function but for entities rather than individuals.

How does the Tax ID Number impact Navy Federal Credit Union’s operations?

+The Tax ID Number is integral to Navy Federal Credit Union’s operations. It ensures accurate taxation, compliance with regulatory frameworks, and efficient financial management. The number is used across various systems and processes, facilitating data management, analysis, and reporting. Its consistent use enhances operational efficiency and transparency.