Navy Federal Cashier's Check Fee

Understanding the various fees associated with banking services is crucial for financial planning and management. In this comprehensive guide, we will delve into the specifics of the Navy Federal Cashier's Check Fee, exploring its purpose, structure, and implications for account holders. By examining this fee, we aim to provide valuable insights into the costs and benefits associated with this particular banking service.

The Nature of Navy Federal Cashier's Checks

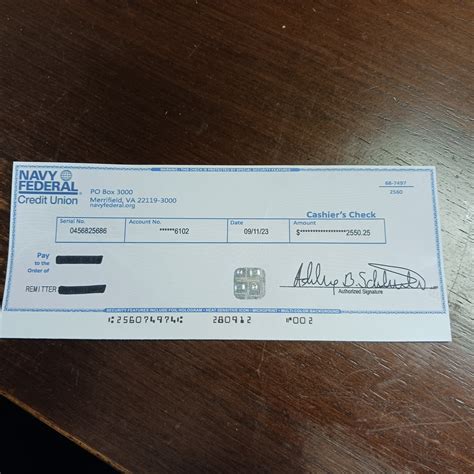

Navy Federal Credit Union, a leading financial institution, offers a range of services tailored to meet the needs of military personnel and their families. Among these services is the issuance of cashier's checks, a secure and trusted method of payment. Cashier's checks are essentially a guarantee by the bank that the funds for the transaction are available and will be paid to the recipient.

These checks are particularly useful in situations where a personal check might not be accepted, such as when making a large purchase or paying for services that require a high level of financial security. They provide an added layer of assurance to both the payer and the recipient, reducing the risk of non-payment or fraud.

Navy Federal Cashier's Check Fee Structure

While Navy Federal Credit Union aims to provide its members with a comprehensive range of services, certain fees are associated with these offerings to cover administrative and operational costs. The cashier's check fee is one such charge, designed to offset the expenses incurred by the credit union when issuing these specialized checks.

The specific fee structure for Navy Federal cashier's checks is as follows:

| Type of Check | Fee |

|---|---|

| Cashier's Check (Standard) | $6 per check |

| Cashier's Check (Money Market) | $10 per check |

It's important to note that these fees are subject to change, and members should refer to the latest fee schedule provided by Navy Federal Credit Union for the most accurate and up-to-date information. The credit union reserves the right to modify its fee structure based on various factors, including economic conditions and operational costs.

Waivers and Exemptions

In certain circumstances, Navy Federal Credit Union may waive the cashier's check fee for its members. This is typically done on a case-by-case basis and may be influenced by factors such as the member's account status, the purpose of the check, or other mitigating circumstances.

For instance, members who hold specific account types, such as certain premium checking accounts, may be eligible for fee waivers as part of the account benefits. Additionally, the credit union may waive fees for specific transactions, such as those related to military deployments or other emergency situations.

Comparative Analysis

When considering the cashier's check fee charged by Navy Federal Credit Union, it's beneficial to compare it with other financial institutions to gain a broader perspective. While each institution has its own fee structure, a general overview can provide valuable insights into the competitiveness of Navy Federal's offering.

Here's a comparison of cashier's check fees across various financial institutions:

| Financial Institution | Cashier's Check Fee |

|---|---|

| Navy Federal Credit Union | $6 (Standard), $10 (Money Market) |

| Bank of America | $10 |

| Chase Bank | $10 |

| Wells Fargo | $10 |

| Citibank | $10 |

As evident from the comparison, Navy Federal Credit Union's cashier's check fee is generally on par with or lower than that of many major banks. This competitive pricing strategy aims to provide value to its members while maintaining a sustainable fee structure.

Implications and Benefits for Members

Understanding the Navy Federal Cashier's Check Fee and its implications can help members make informed decisions about their financial transactions. Here are some key benefits and considerations associated with this fee:

- Cost-Effectiveness: With a relatively low fee, members can access a secure and trusted payment method without incurring excessive costs. This is particularly beneficial for large transactions or situations where personal checks are not an option.

- Security: Cashier's checks offer an added layer of security, ensuring that the recipient receives the funds as promised. This can be crucial for high-value transactions or when dealing with sensitive financial matters.

- Flexibility: Navy Federal Credit Union's fee structure provides members with flexibility. The standard cashier's check fee is suitable for most transactions, while the higher fee for money market checks caters to specific needs or circumstances.

- Waiver Opportunities: The potential for fee waivers, especially in extenuating circumstances, adds an element of flexibility and support for members. This demonstrates the credit union's commitment to its members' financial well-being.

Future Outlook and Recommendations

As the financial landscape evolves, Navy Federal Credit Union is likely to adapt its fee structure to remain competitive and meet the changing needs of its members. Here are some insights and recommendations for the future:

- Digital Innovations: With the increasing trend towards digital banking, Navy Federal could explore ways to integrate cashier's checks into its online platforms. This would enhance convenience and accessibility for members, especially those who prefer digital transactions.

- Fee Structure Review: Regularly reviewing and, if necessary, adjusting the fee structure can help maintain a competitive edge. This should be done in conjunction with market research and feedback from members to ensure the fees remain fair and aligned with industry standards.

- Member Education: Providing members with clear and transparent information about the cashier's check fee, its purpose, and any potential waivers can empower them to make informed decisions. This educational approach can foster trust and satisfaction among members.

Frequently Asked Questions

What is a cashier's check, and why would I need one?

+A cashier's check is a secure form of payment where the bank guarantees the funds for the transaction. It is useful for large purchases or when a personal check might not be accepted, providing an added layer of security and assurance to both the payer and the recipient.

<div class="faq-item">

<div class="faq-question">

<h3>How does the cashier's check fee compare to other financial institutions?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Navy Federal Credit Union's cashier's check fee is generally on par with or lower than that of many major banks. This competitive pricing strategy aims to provide value to members while maintaining a sustainable fee structure.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any circumstances where the cashier's check fee might be waived?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, Navy Federal Credit Union may waive the cashier's check fee on a case-by-case basis. This could be due to the member's account status, the purpose of the check, or other mitigating circumstances. Certain account types may also offer fee waivers as part of their benefits.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I stay updated on the latest fee structures and changes at Navy Federal Credit Union?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Members can access the latest fee schedules and updates through the Navy Federal website or by contacting customer support. It's recommended to periodically review these resources to stay informed about any changes that may impact your financial transactions.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What are the advantages of using cashier's checks over personal checks or other payment methods?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Cashier's checks offer several advantages, including increased security, reduced risk of non-payment or fraud, and acceptance in situations where personal checks might not be an option. They provide a trusted and reliable payment method for high-value transactions.</p>

</div>

</div>

</div>