Does Navy Federal Have A 529 Plan

In the ever-evolving landscape of financial planning, it's essential to explore the various options available to secure a robust financial future. One such avenue that has gained prominence is the 529 plan, a tax-advantaged savings plan designed to make funding education more manageable. Among the many financial institutions offering these plans, Navy Federal Credit Union, or simply Navy Federal, stands out as a prominent player in the market.

Understanding Navy Federal’s 529 Plan

Navy Federal, a credit union dedicated to serving military personnel and their families, offers a comprehensive suite of financial products and services, including the Navy Federal 529 College Savings Plan. This plan is a unique offering tailored to the needs of its membership base, providing a flexible and tax-efficient way to save for higher education expenses.

The Navy Federal 529 Plan is a state-sponsored plan managed by the Virginia College Savings Plan, making it available to anyone, regardless of their state of residence or military affiliation. This plan's key benefit is its flexibility, allowing account holders to save for various qualified education expenses, from tuition and fees to room and board and even computers and books.

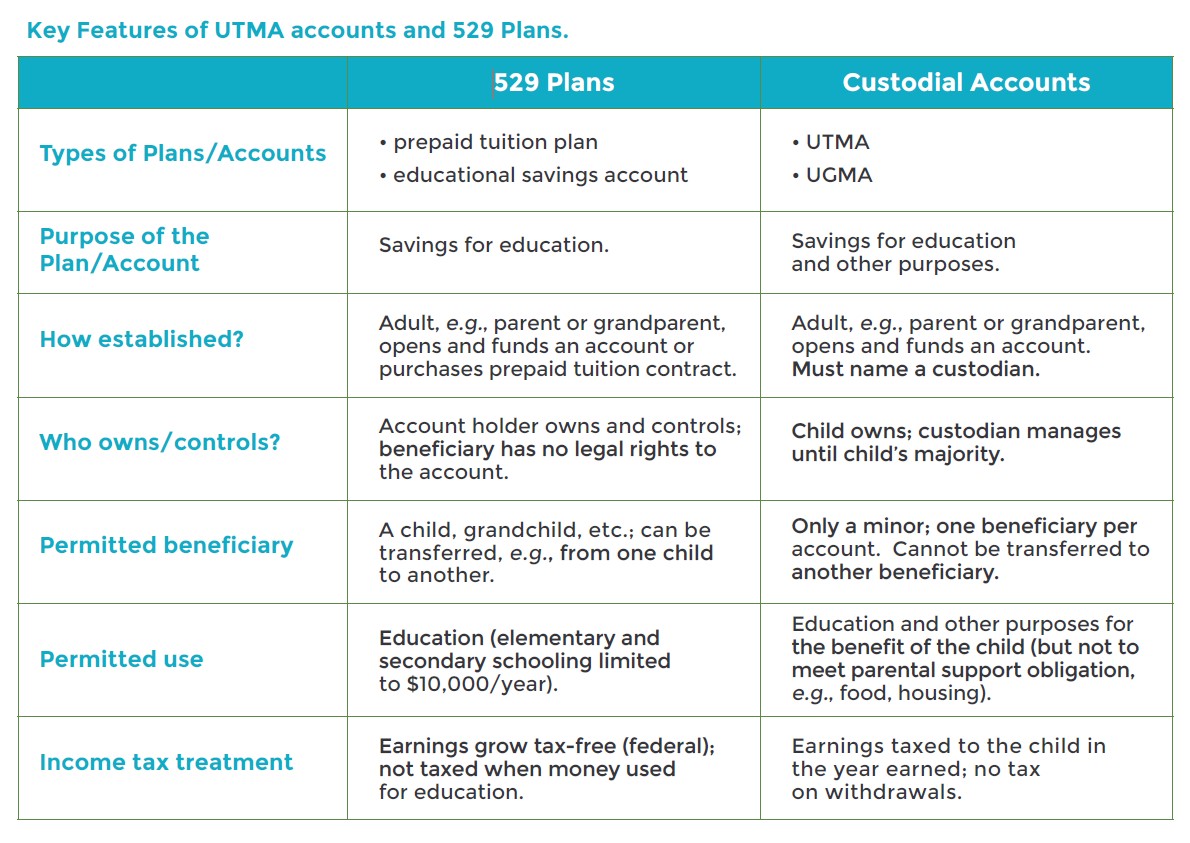

Key Features of the Navy Federal 529 Plan

- Investment Options: The plan offers a range of investment portfolios, including age-based and static investment options, allowing savers to choose an approach that aligns with their risk tolerance and financial goals.

- Tax Benefits: Contributions to the plan are not federally tax-deductible, but they grow tax-free at the federal level and in most states, including Virginia. Additionally, qualified withdrawals are exempt from federal income tax, further enhancing the plan’s tax efficiency.

- Contribution Limits: The Navy Federal 529 Plan allows for substantial contributions, with an annual limit of 428,000 for a single contribution and 856,000 for a joint contribution. This limit applies per beneficiary, making it an attractive option for families with multiple children planning for their education.

- Qualified Withdrawals: Funds can be withdrawn tax-free when used for qualified higher education expenses, including tuition, fees, books, supplies, and equipment. The plan also allows for certain non-qualified withdrawals, subject to federal income tax and a 10% penalty.

| Plan Feature | Details |

|---|---|

| Investment Options | Age-based portfolios, static portfolios, and an option to self-direct investments |

| Tax Benefits | Tax-free growth and tax-free withdrawals for qualified expenses |

| Contribution Limits | $428,000 annually for single contributions; $856,000 for joint contributions per beneficiary |

| Qualified Withdrawals | Tax-free for qualified higher education expenses |

Eligibility and Enrollment

The Navy Federal 529 Plan is open to anyone, regardless of their military status or state of residence. However, it’s essential to note that the plan’s tax benefits are most advantageous for Virginia residents, as they can claim a state income tax deduction for their contributions.

To enroll in the plan, interested individuals can visit the Navy Federal 529 Plan enrollment page. The process involves creating an account, choosing an investment option, and making the initial contribution. Navy Federal provides a range of resources and tools to help savers navigate the enrollment process and understand the plan's features.

Benefits for Military Families

For military families, the Navy Federal 529 Plan offers a unique advantage. It allows servicemembers to use their MyCAA benefits to contribute to the plan, providing an additional funding source for education expenses. This benefit is particularly valuable for military families planning for the educational pursuits of their spouses or children.

Performance and Investment Options

The Navy Federal 529 Plan offers a range of investment options to cater to different risk profiles and financial goals. These options include:

- Age-based Portfolios: These portfolios automatically adjust their asset allocation as the beneficiary gets closer to college age, becoming more conservative over time. This approach is ideal for those who prefer a hands-off investment strategy.

- Static Portfolios: Savers can choose from four static portfolio options, each with a different risk level and asset allocation. These portfolios remain constant over time, providing a more stable investment approach.

- Self-Directed Investing: For those who prefer a more hands-on approach, the plan offers the option to self-direct investments, allowing savers to choose individual securities or funds.

The plan's investment options are managed by professional investment managers, ensuring that savers' funds are allocated efficiently and in line with their chosen strategy. Additionally, the plan's performance is benchmarked against industry standards to ensure its competitiveness.

Performance Benchmarks

According to recent data, the Navy Federal 529 Plan’s investment options have demonstrated competitive performance. For instance, the Age-based 2030 Portfolio, designed for beneficiaries expected to attend college in the year 2030, has shown strong returns over the past 5 and 10 years. This portfolio’s performance has outpaced its benchmark index, highlighting the plan’s efficiency in managing investors’ funds.

| Portfolio | 5-Year Annualized Return | 10-Year Annualized Return |

|---|---|---|

| Age-based 2030 Portfolio | 6.17% | 8.52% |

| Static Moderate Portfolio | 5.38% | 7.49% |

| Static Conservative Portfolio | 3.56% | 5.17% |

Fees and Costs

Like most 529 plans, the Navy Federal 529 Plan involves certain fees and expenses. These costs are essential to understand, as they can impact the overall growth of the savings plan.

Program Management Fees

The plan charges an annual program management fee of 0.30% of the account value, which covers the costs of managing the plan and providing administrative services. This fee is competitive with other 529 plans and is deducted directly from the account’s earnings.

Investment Management Fees

Investment management fees vary depending on the chosen investment option. Age-based and static portfolios have an annual investment management fee of 0.40%, while the self-directed investing option has a 0.20% annual fee. These fees are also deducted from the account’s earnings.

Other Fees

The plan may also charge fees for certain transactions, such as account maintenance fees, excessive trading fees, and non-qualified withdrawal fees. These fees are outlined in the plan’s Program Description and Participant Agreement, which are available on the Navy Federal website.

Conclusion: A Valuable Tool for Education Savings

The Navy Federal 529 College Savings Plan is a robust and flexible tool for anyone looking to save for higher education expenses. Its tax advantages, competitive performance, and flexibility make it an attractive option, especially for military families and individuals seeking a reliable way to fund education. By understanding the plan’s features, investment options, and fees, savers can make informed decisions to achieve their education savings goals.

Frequently Asked Questions

Can anyone enroll in the Navy Federal 529 Plan, or is it exclusive to military personnel and their families?

+

The Navy Federal 529 Plan is open to anyone, regardless of their military status or state of residence. While Navy Federal Credit Union primarily serves military personnel and their families, the 529 Plan is a state-sponsored program available to all U.S. citizens and residents.

What are the tax benefits of the Navy Federal 529 Plan?

+

Contributions to the Navy Federal 529 Plan grow tax-free at the federal level and in most states, including Virginia. Qualified withdrawals are also exempt from federal income tax, providing significant tax advantages for savers. Additionally, Virginia residents can claim a state income tax deduction for their contributions, further enhancing the plan’s tax efficiency.

How do I choose the right investment option for my Navy Federal 529 Plan?

+

The Navy Federal 529 Plan offers a range of investment options, including age-based and static portfolios, as well as the ability to self-direct investments. The choice depends on your risk tolerance, time horizon, and financial goals. Age-based portfolios adjust their asset allocation over time, becoming more conservative as the beneficiary gets closer to college age. Static portfolios offer a more stable approach, while self-directed investing allows for a customized strategy. It’s essential to consider your financial situation and goals when making this decision.

Are there any fees associated with the Navy Federal 529 Plan, and how do they impact my savings?

+

The Navy Federal 529 Plan involves certain fees, including an annual program management fee of 0.30% and an annual investment management fee ranging from 0.20% to 0.40%, depending on the investment option. These fees are deducted from the account’s earnings and can impact the overall growth of your savings. It’s essential to understand these fees and factor them into your long-term savings plan.

Can I use MyCAA benefits to contribute to the Navy Federal 529 Plan, and how does it work?

+

Yes, military servicemembers can use their MyCAA benefits to contribute to the Navy Federal 529 Plan. MyCAA provides up to $4,000 in financial assistance for eligible military spouses pursuing education or training programs. To use MyCAA funds, you must first enroll in the Navy Federal 529 Plan and then submit a request to the MyCAA program, specifying the amount you wish to contribute. The funds will then be transferred to your 529 plan account, allowing you to save for the educational expenses of your spouse or children.