Does Navy Federal Credit Union Do Money Orders

When it comes to financial services, Navy Federal Credit Union (NFCU) is a well-known and trusted institution, offering a wide range of banking solutions to its members. Among the many services provided, the availability of money orders is a common query, as they are a convenient and secure way to make payments or send funds. In this comprehensive article, we will delve into the topic of money orders at Navy Federal Credit Union, exploring their offerings, benefits, and how they can be utilized by members.

Understanding Money Orders at Navy Federal Credit Union

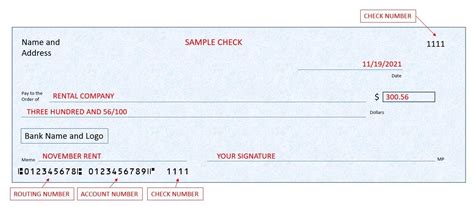

Money orders are a popular alternative to personal checks or cash, especially when making payments to individuals or businesses where other methods may not be feasible. Navy Federal Credit Union recognizes the importance of this financial instrument and provides its members with the option to purchase and utilize money orders. Here’s an in-depth look at how NFCU’s money order service works:

Money Order Availability and Purchase

Navy Federal Credit Union offers money orders to its members at all branch locations across the United States. Members can conveniently purchase money orders during regular business hours. The credit union sets a maximum limit on the value of each money order, typically ranging from 1,000 to 2,000, ensuring security and compliance with regulations.

| Money Order Fee | $5 per money order |

|---|---|

| Maximum Value | $2,000 per money order |

| Payment Methods | Cash, NFCU Debit Card, or Transfer from NFCU Account |

To purchase a money order, members can visit their nearest Navy Federal branch and provide the necessary funds. The credit union accepts cash, NFCU debit cards, or transfers from NFCU accounts as payment methods for money orders. This flexibility ensures that members have various options to suit their financial preferences.

Using Money Orders

Money orders purchased from Navy Federal Credit Union can be used for a wide range of purposes. Members often utilize them for:

- Bill Payments: Paying bills to businesses or service providers that accept money orders as a form of payment.

- Rent or Mortgage Payments: A secure way to send funds for rental or mortgage obligations.

- Online Transactions: Some online platforms or businesses may require money orders for certain transactions.

- Sending Funds to Family or Friends: A safe and reliable method to send money to loved ones, especially when other options are not available.

- International Payments: Money orders can be a convenient way to make international payments, subject to foreign currency exchange rates.

Money orders provide an added layer of security compared to personal checks, as they are prepaid and require proper identification for cashing. This reduces the risk of fraud and ensures that the recipient receives the intended funds.

Benefits of Navy Federal Credit Union Money Orders

Choosing Navy Federal Credit Union for your money order needs offers several advantages. Here are some key benefits:

- Convenience: With a wide network of branches, members can easily access money order services, making it a convenient option for quick financial transactions.

- Affordability: NFCU’s money order fees are competitive, offering an affordable solution for sending funds or making payments.

- Security: Money orders provide a secure way to transfer funds, reducing the risk of loss or theft compared to cash or personal checks.

- Flexibility: Members have the flexibility to choose their preferred payment method, whether it’s cash, debit card, or account transfer.

- Regulated Limits: The maximum value limit on money orders ensures compliance with financial regulations, providing an added layer of security.

Money Order Processing and Cashing

Once a member purchases a money order from Navy Federal Credit Union, the process of cashing or depositing it is straightforward. Here’s an overview of the money order processing and cashing procedure:

Cashing at Navy Federal Credit Union

If the recipient of the money order is also a member of Navy Federal Credit Union, they can conveniently cash the money order at any branch location. The process typically involves the following steps:

- The recipient visits their nearest Navy Federal branch with a valid government-issued ID and the money order.

- The branch representative verifies the money order’s authenticity and the recipient’s identity.

- After successful verification, the funds are deposited directly into the recipient’s NFCU account, ensuring a secure and efficient transaction.

Cashing at Other Financial Institutions

In cases where the recipient is not a member of Navy Federal Credit Union, they can still cash the money order at other financial institutions. However, the process may vary depending on the institution’s policies. Generally, the recipient will need to present the following:

- The money order.

- A valid government-issued ID or passport for identification.

- In some cases, the recipient may need to provide additional information, such as their social security number or driver’s license number.

It's important to note that cashing fees may apply when using non-Navy Federal institutions, and the recipient should check with the specific financial institution for their policies and requirements.

Tracking and Replacing Lost or Stolen Money Orders

Navy Federal Credit Union understands the importance of protecting its members’ financial transactions. In the event of a lost or stolen money order, the credit union provides a tracking and replacement service. Members can contact the NFCU Member Service Center to report the issue and initiate the replacement process. The credit union will then work to verify the money order’s status and, if necessary, issue a replacement money order with a new number.

Comparison with Other Payment Methods

While money orders are a reliable and secure payment method, it’s beneficial to compare them with other options to understand their advantages and limitations. Here’s a brief comparison of money orders with other common payment methods:

Money Orders vs. Personal Checks

Personal checks are a traditional form of payment, but they come with certain risks. Money orders, on the other hand, offer several advantages:

- Security: Money orders are prepaid, reducing the risk of non-payment or bounced checks.

- Convenience: Money orders can be used for larger amounts and are accepted by more businesses and individuals.

- Tracking: With a unique money order number, tracking and replacing lost or stolen funds is easier.

Money Orders vs. Cash

Cash is a straightforward payment method, but it comes with its own set of challenges:

- Security: Carrying large amounts of cash can be risky, and it’s difficult to trace if lost or stolen.

- Convenience: Money orders provide a more secure and convenient alternative, especially for sending funds over long distances.

- Record-Keeping: Money orders come with a receipt, allowing for better record-keeping and documentation.

Money Orders vs. Online Payment Services

Online payment services, such as PayPal or Venmo, have gained popularity for their convenience and speed. However, money orders still hold value in certain scenarios:

- Security: Money orders provide an offline, tangible form of payment, which can be beneficial for transactions with unknown or unverified individuals.

- Accessibility: Not everyone has access to online payment services, making money orders a more inclusive option.

- International Transactions: Money orders can be a more straightforward method for international payments, especially when dealing with businesses or individuals without online payment capabilities.

Tips for Using Navy Federal Credit Union Money Orders

To ensure a smooth and secure experience when using Navy Federal Credit Union’s money order services, here are some valuable tips:

- Keep Records: Always keep a record of the money order number, recipient’s details, and the purpose of the transaction. This will help with tracking and security.

- Verify Recipient: Before purchasing a money order, ensure you have the correct recipient’s details, including their full name and address.

- Choose the Right Payment Method: Consider your financial situation and preferences when selecting the payment method for the money order. Cash, NFCU debit card, or account transfer, each has its advantages.

- Inform the Recipient: Let the recipient know that you have sent a money order, including the approximate date and amount. This can help with timely cashing and avoid any confusion.

- Monitor Tracking Information: If you need to track the status of a money order, use the tracking number provided by Navy Federal Credit Union. This will help you stay informed about its progress.

Conclusion

Navy Federal Credit Union’s money order service offers a reliable, secure, and convenient way for members to make payments or send funds. With competitive fees, a wide network of branches, and a straightforward process, NFCU provides an excellent option for those seeking an alternative to traditional payment methods. Whether for bill payments, rent, or sending funds to loved ones, Navy Federal Credit Union’s money orders are a trusted solution.

FAQ

Can I purchase a money order with a credit card at Navy Federal Credit Union?

+

No, Navy Federal Credit Union does not accept credit cards for money order purchases. They offer cash, NFCU debit card, or account transfer as payment methods.

Is there a limit to the number of money orders I can purchase in a day or month at NFCU?

+

Yes, there are daily and monthly limits on money order purchases at Navy Federal Credit Union. These limits are set to prevent fraud and ensure compliance with regulations. Members should contact NFCU for specific limit details.

Can I cash a money order from another financial institution at Navy Federal Credit Union?

+

Yes, Navy Federal Credit Union accepts money orders from other financial institutions for cashing. Members should present the money order and valid ID for verification.

How long does it take to receive a replacement money order if mine is lost or stolen?

+

The time to receive a replacement money order can vary depending on the circumstances and the information provided. Navy Federal Credit Union aims to process replacement requests promptly, typically within a few business days.

Are there any additional fees for cashing a money order at a non-NFCU institution?

+

Yes, when cashing a money order at a non-Navy Federal institution, there may be additional fees charged by that institution. It’s advisable to check with the specific institution for their fee structure.