Dentist That Do Payment Plans Near Me

Are you in need of dental care but concerned about the financial aspect? Finding a dentist who offers payment plans can provide much-needed relief and ensure you receive the necessary treatment without straining your finances. In this article, we will explore the world of dental payment plans, offering valuable insights and practical tips to help you locate and choose the right dentist that meets your needs.

Understanding Dental Payment Plans

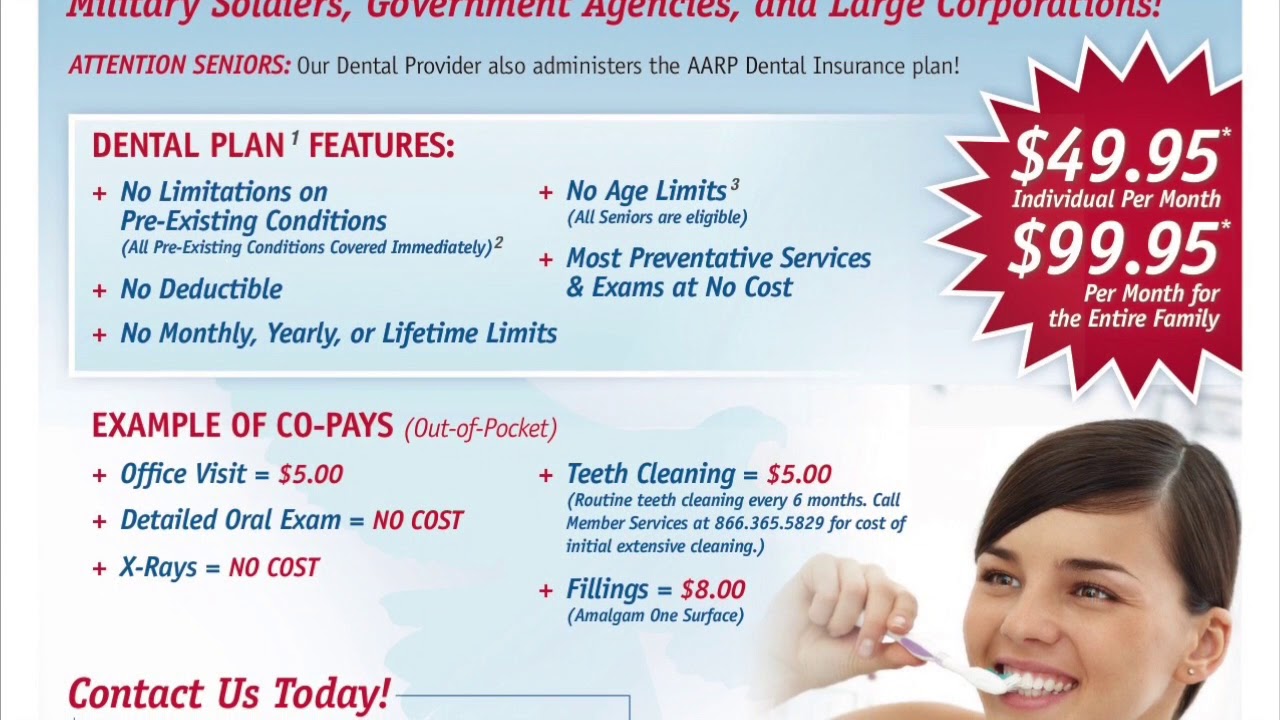

Dental payment plans, also known as financing options, are flexible arrangements that allow patients to receive essential dental treatments while spreading the cost over a specified period. These plans cater to individuals who may not have the financial means to pay for extensive dental procedures upfront. By offering payment plans, dentists aim to make dental care more accessible and affordable, ensuring patients can maintain their oral health without compromising their financial stability.

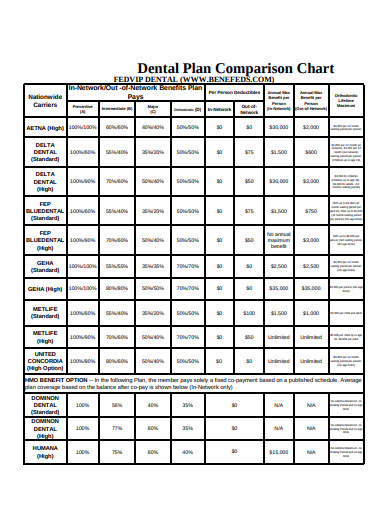

Payment plans can vary in terms of duration, interest rates, and eligibility criteria. Some common types include:

- In-House Payment Plans: Many dental practices offer their own payment plans, tailored to meet the needs of their patients. These plans often have flexible terms and may not require a credit check. In-house plans are a great option for those who prefer a personalized and convenient payment arrangement.

- Third-Party Financing: Dentists may partner with specialized healthcare financing companies to provide patients with access to a range of financing options. These third-party lenders typically offer competitive interest rates and flexible repayment terms. Patients can apply for financing through the dental practice, and once approved, they can proceed with their treatment.

- Insurance-Linked Payment Plans: If you have dental insurance, some providers offer payment plans that are linked to your insurance coverage. These plans may cover a portion of the treatment cost, reducing the overall financial burden. It's worth checking with your insurance provider to understand the available options and eligibility criteria.

Locating Dentists Offering Payment Plans

Finding a dentist that provides payment plans near you can be a straightforward process with the right tools and resources. Here are some steps to help you in your search:

Online Searches

Begin by conducting an online search using relevant keywords such as “dentists offering payment plans near me” or “dental financing options in [your location].” Most dental practices with payment plans will advertise this service on their websites or social media platforms. Explore their online presence to gather initial information about their payment options and contact details.

Utilize Dental Directories

Dental directories, such as Your Dental Guide or Dentistry.com, can be valuable resources for finding dentists in your area. These platforms often allow you to filter search results based on specific criteria, including payment plans. You can quickly identify practices that offer financing options and read reviews from other patients to gauge their reputation.

Check Insurance Provider Networks

If you have dental insurance, check your insurance provider’s website or contact their customer support to inquire about dentists within your network that offer payment plans. Insurance companies often maintain relationships with dental practices, making it easier for you to find a suitable provider that accepts your insurance and offers financing.

Word-of-Mouth Recommendations

Asking for recommendations from friends, family, or colleagues who have undergone similar dental treatments can be a great way to find reliable dentists. Personal referrals can provide insights into the quality of care, professionalism, and, most importantly, the availability of payment plans.

Evaluating Payment Plan Options

Once you’ve located a few dental practices that offer payment plans, it’s essential to evaluate their terms and conditions to choose the most suitable option for your needs and financial situation.

Interest Rates and Fees

Interest rates and associated fees can vary significantly between different payment plans. Compare the annual percentage rates (APRs) and any additional charges, such as application or processing fees. While lower interest rates are preferable, ensure you understand the full cost of the plan, including any potential penalties for late payments.

Repayment Terms

Examine the repayment terms carefully. Consider the duration of the plan, the frequency of payments (monthly, bi-weekly, etc.), and the flexibility allowed in terms of early repayments or payment adjustments. A plan with shorter terms and manageable monthly payments may be more suitable for your budget.

Eligibility Criteria

Review the eligibility criteria for each payment plan. Some plans may have specific requirements, such as a minimum treatment cost or a credit score threshold. Ensure you meet the necessary criteria before applying to avoid disappointment or additional fees.

In-House vs. Third-Party Financing

Decide whether you prefer an in-house payment plan offered by the dental practice itself or a third-party financing option. In-house plans may offer more personalized service and flexibility, while third-party lenders typically provide a wider range of financing options and competitive rates. Weigh the benefits and drawbacks of each to make an informed decision.

Benefits of Dental Payment Plans

Opting for a dental payment plan can bring numerous advantages, ensuring you receive the dental care you need without financial strain. Here are some key benefits:

- Accessible Dental Care: Payment plans break down the cost of dental treatments into manageable installments, making it possible for individuals with limited financial means to access quality dental care.

- Improved Oral Health: By addressing dental issues promptly and undergoing necessary treatments, you can maintain optimal oral health. This prevents small problems from escalating into more complex and costly issues down the line.

- Flexibility and Control: Payment plans offer flexibility in terms of repayment terms and amounts. You can choose a plan that aligns with your budget and financial goals, giving you control over your dental expenses.

- Peace of Mind: Knowing that you have a payment plan in place can alleviate financial stress and allow you to focus on your dental health and well-being.

- Building Credit: Some payment plans may report your repayment history to credit bureaus, which can positively impact your credit score over time.

Tips for a Successful Payment Plan Experience

To ensure a smooth and positive experience with your dental payment plan, consider the following tips:

- Communicate with Your Dentist: Establish open and honest communication with your dentist and their financial team. Discuss your financial situation, express your concerns, and ask questions about the payment plan options available. A transparent dialogue can help you make informed decisions and avoid any misunderstandings.

- Understand the Terms: Carefully read and understand the terms and conditions of your chosen payment plan. Be aware of the repayment schedule, any penalties for late payments, and the total cost of the plan. Clarify any doubts or queries before committing to the plan.

- Stay Organized: Keep track of your payment schedule and due dates. Set reminders or use calendar apps to ensure you make timely payments. Consistent and timely repayments will help maintain a positive relationship with your dentist and avoid any negative impacts on your credit score.

- Consider Your Budget: Select a payment plan that fits comfortably within your budget. While it's essential to receive the necessary dental care, choosing a plan with manageable monthly payments will ensure you can maintain your financial stability and avoid unnecessary stress.

- Explore Additional Resources: If you have specific financial circumstances or concerns, consider reaching out to financial advisors or nonprofit organizations that provide financial guidance and support. They can offer personalized advice and help you navigate the financial aspects of dental care.

The Future of Dental Payment Plans

The landscape of dental payment plans is constantly evolving to meet the changing needs of patients. Here’s a glimpse into the future of dental financing:

Increased Accessibility

As the demand for accessible dental care grows, more dental practices are expected to offer a variety of payment plans to cater to a diverse range of patients. This trend will make dental treatment more affordable and encourage individuals to prioritize their oral health.

Digital Payment Solutions

With the advancement of technology, we can anticipate the integration of digital payment solutions into dental practices. Secure online payment portals and mobile apps will provide patients with convenient and efficient ways to manage their payment plans, view transaction histories, and make repayments.

Expanded Financing Options

Dental financing companies are likely to expand their offerings, providing patients with a wider range of financing options. This could include more flexible terms, lower interest rates, and plans tailored to specific dental procedures, making it easier for patients to find a plan that suits their needs.

Patient Education

Dental practices are recognizing the importance of patient education in financial matters. Expect to see more practices providing comprehensive information about payment plans, including clear explanations of terms, interest rates, and repayment schedules. This empowers patients to make informed choices and manage their dental expenses effectively.

Conclusion

Finding a dentist that offers payment plans near you is a crucial step towards achieving and maintaining good oral health. By understanding the different types of payment plans, conducting thorough research, and evaluating the terms and conditions, you can make an informed decision that aligns with your financial situation. Dental payment plans provide a bridge between necessary dental care and financial stability, ensuring you can prioritize your oral health without compromising your overall well-being.

How do I know if a dentist offers payment plans?

+You can find out if a dentist offers payment plans by checking their website, social media pages, or by giving them a call. Most dental practices that provide financing options will advertise them on their online platforms or through patient testimonials. If you’re unsure, don’t hesitate to reach out to the dental office directly and inquire about their payment plan offerings.

Are there any hidden fees associated with dental payment plans?

+It’s important to carefully review the terms and conditions of any dental payment plan to understand all associated fees. While most plans will have transparent fees, it’s always advisable to clarify any potential hidden costs or penalties for late payments. Ensure you have a clear understanding of the total cost of the plan before committing.

Can I use a dental payment plan for cosmetic procedures?

+Dental payment plans are often available for a wide range of procedures, including cosmetic treatments. However, the eligibility and terms may vary depending on the type of procedure and the dentist’s policies. It’s best to discuss your specific needs and treatment plans with your dentist to determine if a payment plan can be applied to your desired cosmetic procedure.

What happens if I miss a payment on my dental payment plan?

+Missing a payment on your dental payment plan can have consequences, such as late fees, interest rate adjustments, or even negative impacts on your credit score. It’s crucial to stay organized and make timely payments to avoid any additional financial burdens or strains on your relationship with your dentist. If you anticipate difficulties in making a payment, it’s best to communicate with your dentist’s financial team to explore potential solutions.