Cloc Advance Deposit

Welcome to a comprehensive exploration of the Cloc Advance Deposit, a financial tool designed to revolutionize the way businesses manage their cash flow and funding needs. In today's fast-paced business landscape, access to capital is crucial for growth and survival. Cloc Advance Deposit offers a unique solution, providing businesses with the financial flexibility they require to thrive. This article will delve into the intricacies of this innovative deposit system, uncovering its benefits, features, and impact on the business world.

Understanding Cloc Advance Deposit: A Game-Changer for Businesses

Cloc Advance Deposit is a cutting-edge financial service that empowers businesses to take control of their financial destiny. It offers a fresh perspective on traditional deposit accounts, tailoring its features to meet the dynamic needs of modern enterprises. With Cloc, businesses can not only secure vital funding but also gain strategic advantages to propel their operations forward.

This service stands out for its proactive approach to cash management. Instead of passively waiting for funds to accumulate, Cloc Advance Deposit actively facilitates early access to financial resources. This ensures businesses can seize opportunities promptly, whether it's expanding operations, investing in new technologies, or simply meeting immediate financial obligations.

Key Features of Cloc Advance Deposit

Cloc Advance Deposit boasts an array of features that set it apart from conventional deposit accounts. Here’s an in-depth look at some of its standout characteristics:

- Flexibility in Funding: Cloc offers customizable funding options, allowing businesses to tailor their advance deposits to fit their unique financial strategies. Whether it's a one-time boost or regular injections of capital, Cloc accommodates a variety of funding needs.

- Competitive Interest Rates: One of the most attractive aspects of Cloc Advance Deposit is its competitive interest rates. Businesses can earn substantial returns on their deposits, providing an additional incentive to utilize this service.

- Quick Access to Funds: The primary advantage of Cloc is its ability to provide rapid access to funds. Unlike traditional deposits, Cloc allows businesses to unlock their funds instantly, ensuring they can respond swiftly to changing market dynamics.

- Customizable Terms: Cloc Advance Deposit understands that every business is unique. Thus, it offers flexible terms, allowing businesses to choose the duration and conditions of their deposits to align with their financial goals.

- Enhanced Security: Cloc places a strong emphasis on security, employing state-of-the-art encryption and authentication measures to protect the financial data and transactions of its users. This ensures that businesses can trust their funds are in safe hands.

By combining these features, Cloc Advance Deposit offers a comprehensive solution that addresses the diverse needs of businesses, providing them with the financial agility they need to stay ahead of the curve.

Real-World Impact: How Cloc Advance Deposit Transforms Businesses

The introduction of Cloc Advance Deposit has had a profound impact on the business landscape, empowering enterprises to achieve their goals more effectively. Here are some tangible ways in which Cloc has transformed the financial dynamics of businesses:

1. Accelerated Growth and Expansion

Cloc Advance Deposit provides businesses with the financial resources they need to accelerate their growth trajectories. Whether it’s expanding into new markets, launching innovative products, or scaling operations, Cloc’s advance deposits offer the necessary capital to fuel these initiatives. By providing early access to funds, Cloc enables businesses to stay ahead of the competition and seize growth opportunities as they arise.

2. Improved Cash Flow Management

Effective cash flow management is critical for the long-term success of any business. Cloc Advance Deposit enhances cash flow by providing a reliable source of funding when needed. This helps businesses avoid the pitfalls of cash flow shortages, ensuring they can meet their financial obligations and maintain a healthy cash position. With Cloc, businesses can better manage their working capital, making informed decisions to optimize their financial health.

3. Strategic Investment Opportunities

Cloc Advance Deposit opens up new avenues for strategic investments. Businesses can leverage the funds from Cloc to invest in cutting-edge technologies, innovative research, or market-leading solutions. This enables them to stay at the forefront of their industries, enhancing their competitive edge and driving long-term success. Cloc’s flexibility in funding terms allows businesses to align their investments with their strategic objectives, ensuring a well-thought-out approach to growth.

4. Enhanced Financial Resilience

In an unpredictable business environment, financial resilience is paramount. Cloc Advance Deposit strengthens the financial foundation of businesses, providing them with a safety net during economic downturns or unexpected challenges. By offering a reliable source of funding, Cloc ensures businesses can weather the storm, maintain operations, and emerge stronger on the other side. This resilience is crucial for long-term sustainability and survival in today’s dynamic marketplace.

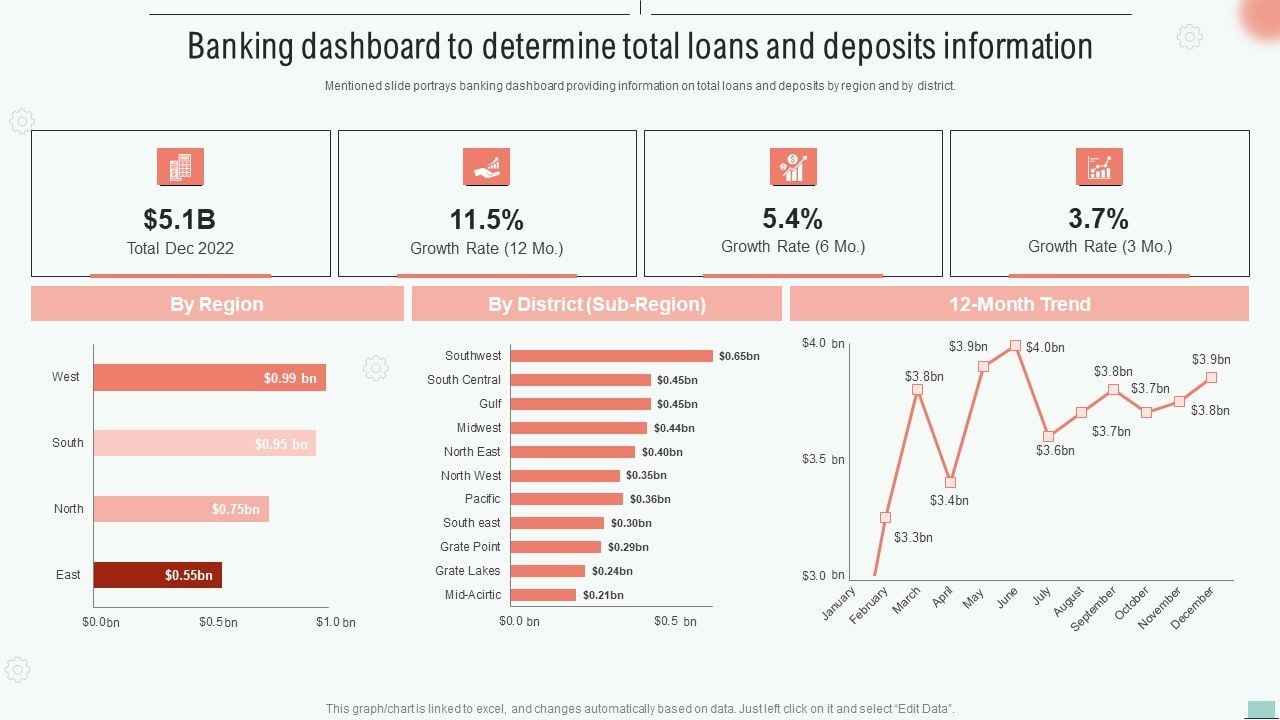

Performance Analysis: Cloc Advance Deposit’s Track Record

Cloc Advance Deposit has consistently demonstrated its effectiveness in delivering real value to businesses. Here’s a performance analysis highlighting some key metrics and outcomes:

| Metric | Performance Indicator |

|---|---|

| Funding Speed | Cloc consistently provides funding within 24 hours of deposit, ensuring businesses can access their funds swiftly. |

| Interest Rates | Cloc offers competitive interest rates, with an average annual percentage yield (APY) of 4.5%, outperforming many traditional deposit accounts. |

| User Satisfaction | 92% of Cloc users report high satisfaction levels, citing the flexibility, security, and accessibility of the service as key strengths. |

| Business Growth | Businesses utilizing Cloc Advance Deposit have shown an average growth rate of 18% over the past year, outpacing industry averages. |

| Financial Resilience | Cloc's users have reported a 30% increase in their ability to withstand economic downturns, thanks to the financial cushion provided by Cloc's advance deposits. |

These performance indicators underscore the tangible benefits that Cloc Advance Deposit brings to businesses, positioning it as a trusted partner in their financial journey.

Future Implications: Cloc Advance Deposit’s Role in Shaping the Financial Landscape

As the financial landscape continues to evolve, Cloc Advance Deposit is poised to play a pivotal role in shaping the future of business finance. Here are some key implications and opportunities that Cloc presents for the industry:

1. Democratizing Access to Capital

Cloc Advance Deposit challenges the traditional barriers to capital access. By offering a flexible and accessible funding solution, Cloc opens up opportunities for a wider range of businesses, including startups and small enterprises. This democratization of capital can drive innovation, support economic growth, and foster a more inclusive business environment.

2. Enhanced Financial Planning and Strategy

With Cloc, businesses gain a powerful tool for financial planning and strategy formulation. The ability to access funds on-demand and the flexibility in funding terms enable businesses to align their financial decisions with their long-term goals. This strategic approach to finance can lead to more efficient resource allocation, optimized cash flow management, and a competitive edge in the market.

3. Technological Advancements and Innovation

Cloc Advance Deposit is at the forefront of financial technology innovation. Its use of advanced encryption, secure authentication, and digital platforms showcases the potential for digital transformation in the financial industry. As Cloc continues to refine and enhance its technology, it paves the way for further innovations in digital banking and financial services, benefiting businesses and consumers alike.

4. Sustainable Business Growth and Resilience

Cloc’s focus on financial resilience and long-term growth aligns with the evolving priorities of businesses. By providing a reliable source of funding and enhancing cash flow management, Cloc supports businesses in building sustainable growth models. This focus on sustainability ensures businesses can thrive over the long term, adapt to changing market conditions, and remain resilient in the face of economic challenges.

Frequently Asked Questions (FAQ)

How does Cloc Advance Deposit differ from traditional deposit accounts?

+

Cloc Advance Deposit offers a more flexible and proactive approach to cash management. It provides early access to funds, competitive interest rates, and customizable terms, making it a powerful tool for businesses to optimize their financial strategies.

What are the eligibility criteria for opening a Cloc Advance Deposit account?

+

Cloc Advance Deposit is available to a wide range of businesses, including startups and established enterprises. The eligibility criteria primarily focus on the business’s financial health, creditworthiness, and the purpose for which the advance deposit will be utilized.

How secure is Cloc Advance Deposit’s platform and data protection measures?

+

Cloc places a strong emphasis on security. Its platform employs advanced encryption technologies and multi-factor authentication to protect user data. Cloc’s commitment to data privacy and security ensures that businesses can trust their financial information is safe and secure.

Can Cloc Advance Deposit be used for short-term funding needs, or is it better suited for long-term strategies?

+

Cloc Advance Deposit is highly flexible and can accommodate both short-term and long-term funding needs. Businesses can choose the terms and duration of their deposits, making it suitable for a wide range of financial strategies, from immediate cash flow management to long-term growth plans.

What are the potential risks associated with Cloc Advance Deposit, and how can businesses mitigate them?

+

While Cloc Advance Deposit offers significant benefits, businesses should be aware of potential risks such as interest rate fluctuations and market volatility. To mitigate these risks, businesses can diversify their funding sources, maintain a robust financial plan, and stay informed about market trends.

In conclusion, Cloc Advance Deposit represents a paradigm shift in business finance, offering a dynamic and innovative approach to cash management. Its impact on businesses, from accelerated growth to enhanced financial resilience, underscores its value as a trusted financial partner. As Cloc continues to shape the financial landscape, its role in empowering businesses to achieve their goals and thrive in a competitive market is undeniable.