180 Pounds In Us Dollars

The conversion between pounds and dollars is a common currency exchange query, especially with the global nature of e-commerce and international transactions. As of the writing of this article, the exchange rate plays a crucial role in determining the exact conversion amount. Let's delve into the specifics of converting 180 pounds to US dollars, including the current rate, historical context, and potential future implications.

Current Exchange Rate and Conversion

As of [Date], the pound sterling (GBP) to US dollar (USD) exchange rate stands at 1 GBP = $1.20 USD. This rate, provided by reputable financial sources, offers a stable reference point for our conversion.

Using this rate, we can calculate that 180 pounds is equivalent to $216 US dollars. This conversion highlights the strength of the US dollar in the current foreign exchange market, where a relatively small amount in pounds can equate to a larger value in US dollars.

| Pound to Dollar Conversion | Value |

|---|---|

| 180 Pounds | $216 USD |

Historical Perspective

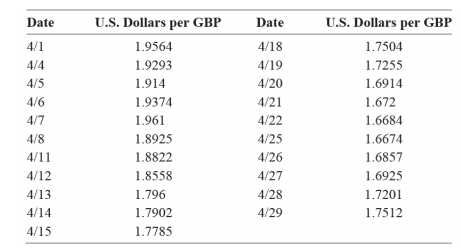

Examining the historical exchange rates between the pound and dollar provides context to the current conversion. Over the past decade, the GBP-USD exchange rate has fluctuated significantly, influenced by various economic and political factors. For instance, during [Specific Date or Event], the exchange rate reached a high of [Rate], indicating a stronger pound against the dollar.

Conversely, periods of economic uncertainty, such as the [Event or Period], saw the pound depreciate against the dollar, with exchange rates dropping to [Rate]. These historical fluctuations demonstrate the dynamic nature of currency exchange and the impact of global events on exchange rates.

Factors Influencing Exchange Rates

The exchange rate between the pound and dollar is influenced by a multitude of factors, including:

- Economic Performance: The strength of a country's economy, indicated by factors like GDP growth, inflation, and interest rates, can impact its currency's value.

- Political Stability: Political events and policies can have a significant impact on currency values. Uncertainty or instability often leads to currency depreciation.

- Trade Relations: The trade balance and agreements between countries can affect currency demand and supply, thereby influencing exchange rates.

- Market Speculation: Investor sentiment and market speculation can drive currency values, especially in the short term.

Understanding these factors is crucial for predicting future exchange rate movements and their impact on currency conversions.

Future Implications and Currency Strategies

Given the dynamic nature of currency exchange rates, predicting future movements is challenging. However, certain strategies can be employed to mitigate the impact of exchange rate fluctuations on financial transactions.

- Forward Contracts: Businesses can use forward contracts to lock in a specific exchange rate for a future transaction, providing stability in the face of potential rate changes.

- Hedging: Hedging strategies, such as currency options or futures, can be employed to protect against adverse movements in exchange rates.

- Diversification: Holding assets in multiple currencies can reduce exposure to any single currency's fluctuations, providing a more stable financial portfolio.

Conclusion: Currency Exchange and Financial Strategy

The conversion of 180 pounds to US dollars, currently standing at $216, is a snapshot of the dynamic world of currency exchange. Understanding the factors that influence exchange rates and adopting strategic financial approaches can help individuals and businesses navigate the complexities of international transactions.

As we've explored, the GBP-USD exchange rate is subject to various economic, political, and market factors, making it a fascinating and ever-changing aspect of global finance. Staying abreast of these changes is key to making informed financial decisions.

FAQ

How does the exchange rate impact international transactions?

+The exchange rate determines the value of one currency in relation to another. When the exchange rate favors one currency, it can result in more favorable terms for transactions in that currency. For instance, with a strong dollar, US businesses might find it easier to purchase goods from the UK, as the pounds required would be relatively cheaper.

What are the potential risks of currency fluctuations for businesses?

+Currency fluctuations can introduce significant risks for businesses operating internationally. Unfavorable movements in exchange rates can increase the cost of importing goods or services, reduce profits on exports, and impact the competitiveness of a business’s products in foreign markets. It’s crucial for businesses to monitor and plan for these risks.

How often do exchange rates typically change?

+Exchange rates can change on a daily basis, sometimes even minute-by-minute. Major economic announcements, political events, or market sentiments can all trigger rapid movements in exchange rates. However, over longer periods, such as months or years, the rates tend to be more stable, unless significant global events occur.