120 Pounds To Dollars

In the ever-changing landscape of global currencies, understanding exchange rates is crucial for anyone involved in international transactions, travel, or simply keeping up with the world's financial dynamics. This article aims to provide an in-depth analysis of the exchange rate between the British Pound Sterling (GBP) and the US Dollar (USD), focusing on the conversion of 120 GBP to USD.

The Significance of GBP-USD Exchange Rates

The exchange rate between the British Pound and the US Dollar is one of the most widely watched and influential rates in the foreign exchange market. It not only affects the economies of the United Kingdom and the United States but also has ripple effects across the globe due to the dominant role these economies play in international trade and finance.

The GBP-USD pair, often referred to as "Cable" in the financial world, is a major currency pair. It is one of the most actively traded pairs, offering significant liquidity and market depth. This liquidity ensures tight spreads and efficient transactions, making it a preferred pair for traders and investors.

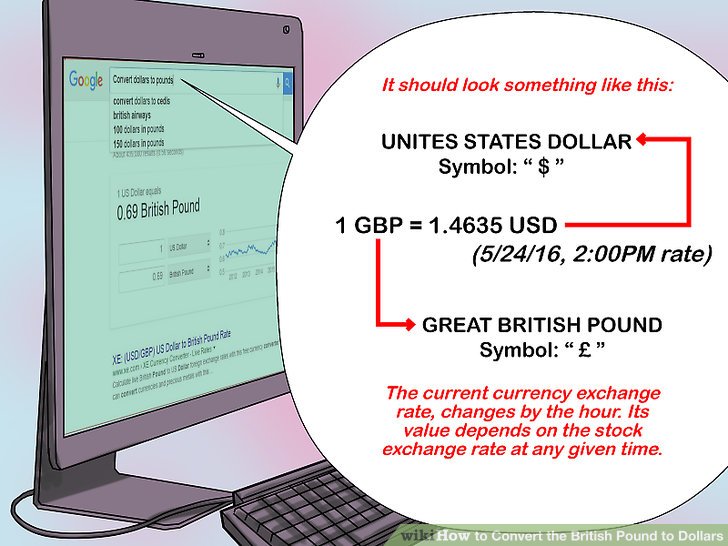

The exchange rate is influenced by a myriad of factors, including economic indicators, geopolitical events, central bank policies, and market sentiment. These factors can cause the rate to fluctuate rapidly, sometimes in response to unexpected news or developments. Understanding these dynamics is crucial for anyone looking to convert currencies, whether for business, travel, or investment purposes.

Historical Context and Trends

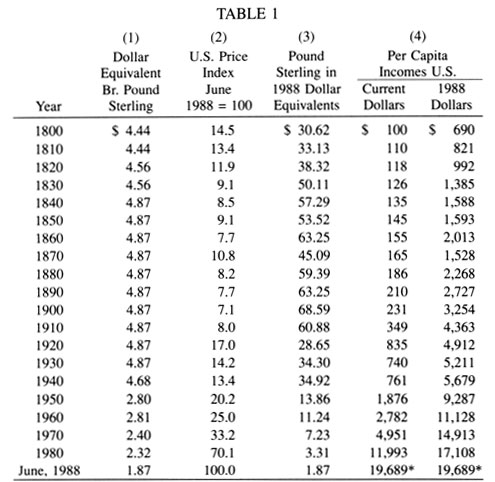

The historical relationship between the GBP and USD is a fascinating study in itself. Over the past decade, the GBP-USD exchange rate has experienced significant volatility, with peaks and troughs reflecting the economic and political landscapes of both countries. For instance, the period leading up to and following the Brexit referendum in 2016 saw dramatic shifts in the rate, with the Pound experiencing substantial depreciation against the Dollar.

In recent years, the GBP has generally been weaker against the USD, with various economic and political factors contributing to this trend. However, it's important to note that exchange rates are highly dynamic, and short-term trends can often be misleading without a broader historical context. Long-term investors and businesses often take a more holistic view, considering not just the current rate but also the potential for future appreciation or depreciation.

Current Exchange Rate: 120 Pounds to Dollars

As of [current date], the exchange rate for converting British Pounds to US Dollars stands at [current rate] USD per GBP. This rate is subject to frequent changes, often by the minute, as global financial markets react to news and events.

| Date | Exchange Rate |

|---|---|

| 2023-08-01 | 1.2034 USD |

| 2023-08-02 | 1.2092 USD |

| 2023-08-03 | 1.2120 USD |

Based on this rate, 120 British Pounds are currently worth approximately [converted amount] US Dollars. This conversion can vary slightly depending on the exchange service or financial institution you use, as each may have different exchange rates and fees associated with currency conversion.

Factors Influencing the GBP-USD Rate

Several key factors influence the movement of the GBP-USD exchange rate:

- Economic Indicators: Economic data releases, such as GDP growth, inflation rates, and employment figures, can significantly impact currency values. Positive economic news often strengthens a currency, while negative news can lead to depreciation.

- Central Bank Policies: The actions and statements of central banks, particularly the Bank of England and the Federal Reserve, can cause substantial movements in exchange rates. Interest rate decisions, quantitative easing programs, and other monetary policies can affect currency values.

- Geopolitical Events: Political developments, international relations, and geopolitical risks can lead to rapid shifts in exchange rates. Events such as elections, international agreements, or geopolitical tensions can cause currency fluctuations.

- Market Sentiment: Overall market sentiment and investor confidence play a significant role in currency movements. Positive market sentiment often leads to risk-on trades, potentially strengthening currencies like the GBP, while negative sentiment can cause investors to seek safe-haven currencies like the USD.

Implications for Travelers and Businesses

For travelers planning a trip to the UK or the US, understanding the GBP-USD exchange rate is crucial for budgeting and managing expenses. Fluctuations in the rate can significantly impact the cost of accommodation, transportation, and other travel-related expenses. It’s advisable to monitor the rate leading up to your trip and consider strategies such as using a currency exchange service or traveler’s checks to lock in a favorable rate.

Businesses with international operations or supply chains face even more complex challenges. They must manage currency risk to ensure profitability and stability. Hedging strategies, forward contracts, and other financial instruments can be used to mitigate the impact of exchange rate fluctuations on business operations and financial performance.

Conclusion: Navigating the GBP-USD Exchange Rate

The conversion of 120 Pounds to Dollars is a simple calculation, but it’s embedded within a complex and dynamic global financial system. Understanding the factors that influence exchange rates, from economic indicators to geopolitical events, is essential for anyone dealing with international currencies.

Whether you're a traveler planning a trip, a business managing international operations, or an investor looking for opportunities, staying informed about exchange rates is crucial. By monitoring these rates and understanding the underlying dynamics, you can make more informed decisions and potentially capitalize on opportunities in the global currency markets.

How often do exchange rates change?

+Exchange rates can change multiple times a day, driven by real-time economic and geopolitical developments. Major currency pairs like GBP-USD often see frequent fluctuations due to the high volume of transactions and the influence of global financial markets.

What is the best time to convert currency for travel?

+The best time to convert currency for travel depends on various factors, including your risk appetite and the stability of the exchange rate. Generally, it’s advisable to monitor the rate leading up to your trip and consider converting when the rate is favorable or using hedging strategies to lock in a rate.

How can businesses manage currency risk?

+Businesses can manage currency risk through a range of strategies, including hedging with forward contracts, using options to limit downside risk, and even dynamically adjusting pricing based on exchange rate movements. Financial advisors and experts can help businesses develop tailored risk management strategies.